Changing Financial Tides

January 5, 2023

Life Insurance and Changing Financial Tides

Indexed Universal Life (IUL) Cap rates have reached low tide, which makes long-term projections much less attractive for current and future policy holders. It is not hyperbole to say “every IUL policy sold in the last 10 years illustrates lower today than it did when it was sold”1. Some will argue this, but that does not provide answers about the future of permanent products, including Whole Life, IUL, and UL. Interest rates have been trending down for decades. When will interest rates, Index Caps, and policy crediting reverse course?

Two of the Most Common Distractions Regarding Crediting

1 – Short-Term Interest Rates2:

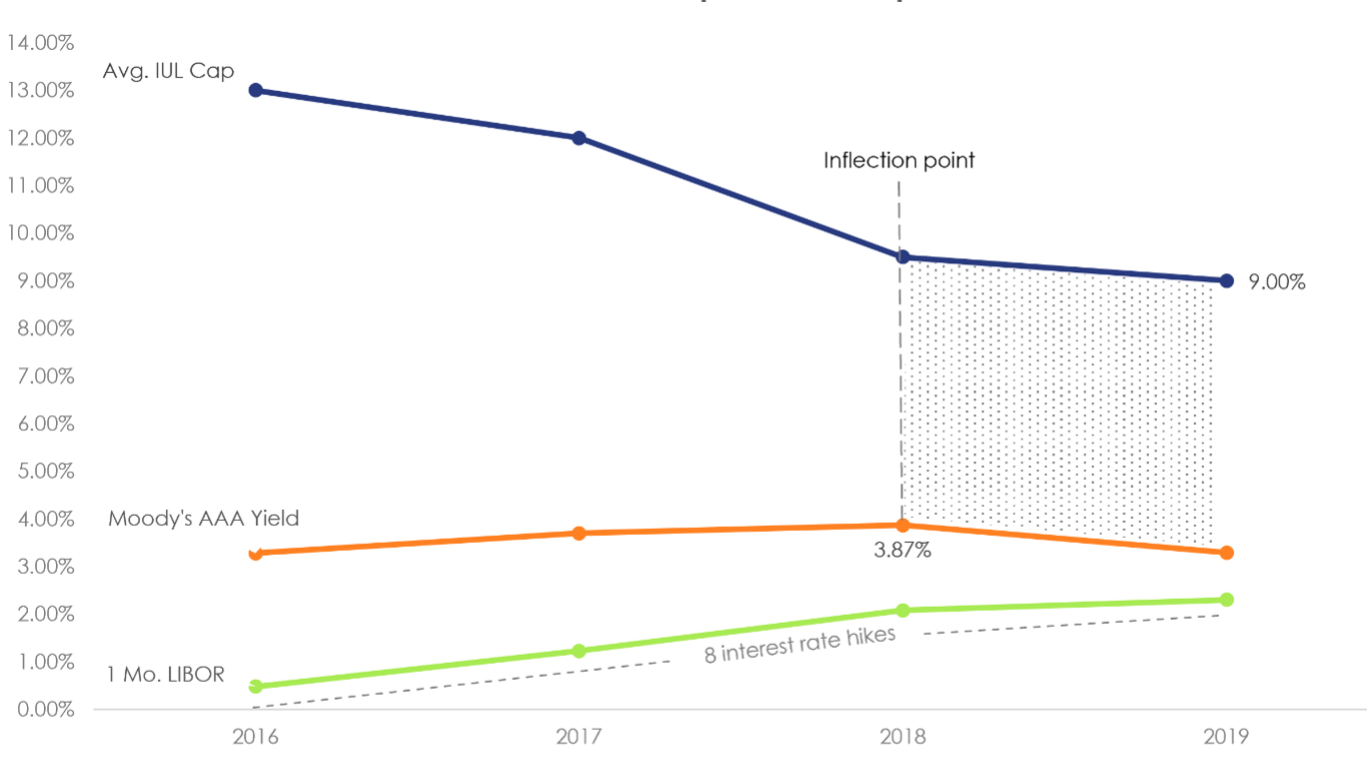

Rising interest rates do not translate to higher Cap rates in the short-term because higher interest (and volatility) increases the cost of options that insurers buy to create the Cap and Floor that define a typical S&P 500 index account. The easiest way to validate the disconnect between interest rates and index caps is to look at data from the last rising interest rate cycle from 2016 to 2019.

IUL Caps vs. Increasing Interest Rates

Source: Schechter Wealth. FRED

The chart above shows that eight interest rate increases had almost no impact on Cap rates. At the end of the cycle in 2019, interest rates were still increasing, and Caps were still going down. To borrow an analogy from a colleague, “short-term interest rates are just waves splashing against the Titanic.”

A corporate bond index is a better barometer for potential changes in Cap rates. If increases are sustained month over month, the yields will show up as profits in General Accounts. At the peak in 2018, you can see an inflection point where Aaa yields slightly alter the downward trajectory of Caps, but not enough to reverse course.

2 – Index Options:

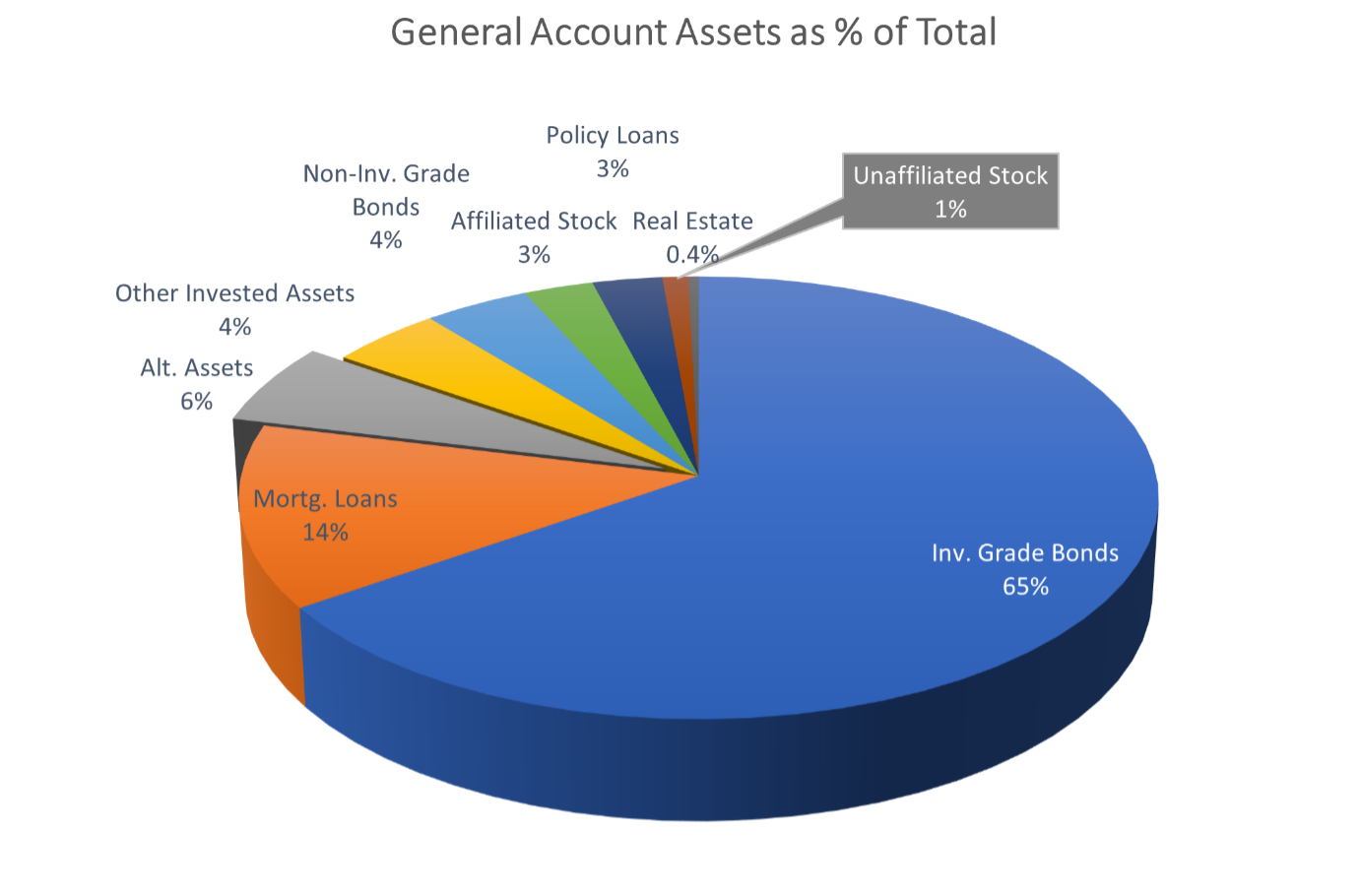

This is one of the great head-fakes in product Marketing. Life Insurance 101 taught us that all Universal Life products are General Account products, including Indexed UL. Therefore, by definition, IUL premium dollars are invested in the carrier’s GA portfolio not an index fund. Index accounts are shadow accounts. They are a sandbox of equities where marketers can model hypothetical results using various Caps, Floors, Spreads, Indexes, Derivatives, Loan Strategies, Volatility Controls, etc. that are not directly associated with the investment of client money.

The average General Account portfolio consists of 1% (unaffiliated) stock. The other 99% is distributed across asset classes that perform differently than an index account.

Source: ALIRT U.S Life Insurance Industry Review, Year End 2021

Why does the industry devote so many resources to the Index game? I think the steady introduction of new indexes has become a marketing platform of its own. It’s a convenient distraction where increasingly complex market schemes are molded for point of sale, then unceremoniously eroded by the reality of General Account investments.

When the index honeymoon is over, the long-term performance of insurance products is tethered to the insurer’s General Account, specifically Net Investment Yield, by a leash that has been getting shorter and shorter.

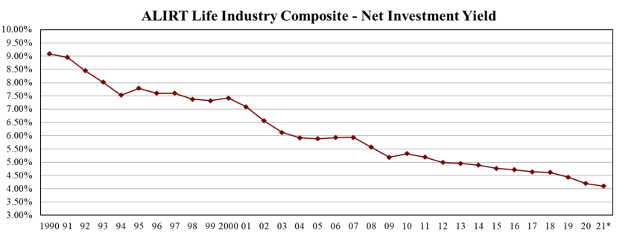

The following chart makes it clear that Net Investment Yield is the ugly truth behind product performance, which also makes a good starting point for better analysis:

Source: ALIRT Life Insurance in Transition: 2009 – 2021. *Yield is annualized for the first six months of 2021.

In general, Net Investment Yield is the source of funds that carrier’s use to determine product budgets (plus whatever the carrier is willing to commit to new business acquisition). It’s no surprise that Caps and crediting have followed this same trajectory.

So, what’s drives Net Investment Yield? Investment grade bonds make up 65% of yield potential. The good news is bond yields are on the rise. A 50/50 mix of Aaa and Baa corporate bond yields have risen from 3.12% to 5.48% in 2022.1 The steep climb in yields may offset the increased cost of options. So far, the industry has not seen a wave of fresh Cap decreases that many analysts projected. Rather fixed crediting accounts have started to increase rates, and I am confident that increases in IUL Cap rates will follow in the next 6 months.

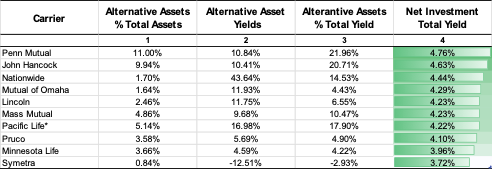

Insurers with a diversified mix of assets have fared better than those who rely too heavily on bonds. This table illustrates how relatively small alternative investments can have a disproportionate impact on GA yield:

5 Year Averages (2017-2021)

Source: ALIRT 5 Year Trend Analysis.

Alternative investments are private equity funds, hedge funds, joint ventures, and other high risk/return investments. Insurers investments in alternative assets increased 23% from 2017 to 2021.

The opening paragraph, questioned the future direction of long-term interest rates and policy crediting? We can only speculate, but some economists think fundamental macro-economic conditions are changing. There are signs that the last three decades of deflation and decreasing interest rates bottomed out in 2021. Enormous changes in demography and globalization may support a full-scale reversal that’s already underway. Specifically, an aging (shrinking) work force and political opposition to global trade may drive inflation and interest rates for the foreseeable future (Goodhart). If the forces that pushed portfolio yields down for so long are reversing, it’s logical to think yields themselves will go in the other direction as well.

I am optimistic that the new economic environment will bring higher Caps, and crediting to all index-based insurance products by the end of 2022.

Sources:

1. Moody’s Corporate Bond Yield, retrieved from FRED, Federal Reserve Bank of St. Louis.

2. Goodhart, and Pradhan. The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation Revival. Palgrave Macmillan, 2020.

3. ALIRT Insurance Research, U.S. Life Insurance Industry Review Year-End 2021. Windsor, CT 06095

4. ALIRT Insurance Research, Life Insurance Industry in Transition 2009-2021. Windsor, CT 06095