We’re “In the Money”

September 6, 2023

Acquiring a Long-Term Hedge on Financed Life Insurance Premiums Results in Us Being “In the Money” On Day One

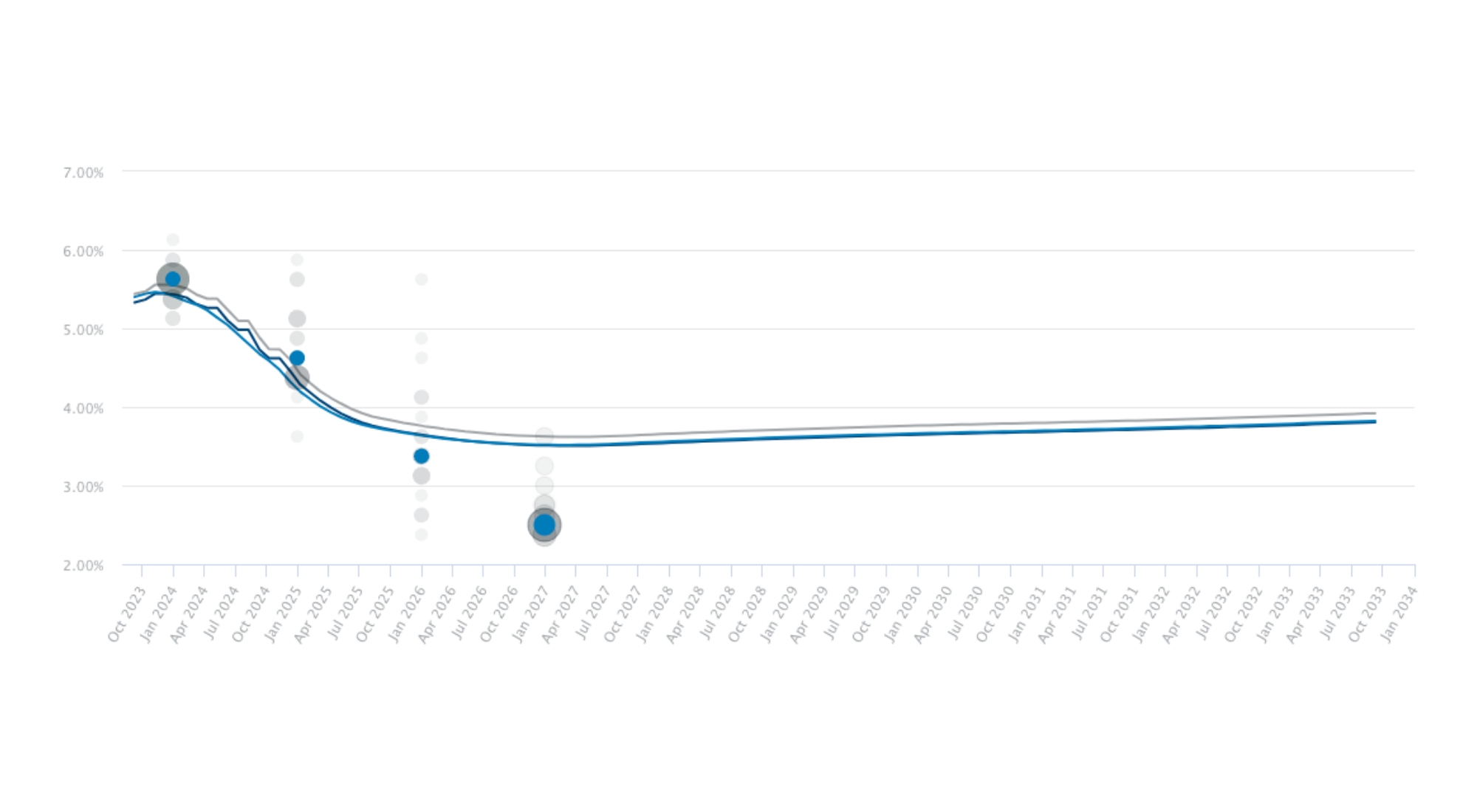

In the current financial landscape, there exists a notable discrepancy between short-term and long-term interest rates. Today, short-term money comes at a higher cost, while long-term funds are below historic averages.1 This piece delves into the reasons behind this phenomenon, highlighting the consideration for long-term borrowing to finance Life Insurance policies. Additionally, we explore the consistent approach of modern monetary policy in targeting inflation and maintaining a neutral impact on the economy.

Short-Term vs. Long-Term Interest Rates:

Short-term interest rates are high. A comprehensive analysis of various metrics, including forward curves, derivative pricing, and the Federal Reserve's Dot Plot, suggests that these elevated rates are temporary.1 Looking ahead, expectations indicate a substantial decline in rates over the long term.

Rationale for the Cost Disparity - The cost dynamics between short-term and long-term interest rates stem from several factors:

- Monetary Policy Consistency: Modern monetary policy consistently aims to target inflation within the 2-2.5% range.2 Over the years, the Federal Reserve has emphasized that a Fed Funds rate in this range would have a neutral impact on the economy. Unless specific circumstances warrant adjustments to economic growth, interest rates should ideally remain within this target range.

- Market Metrics: Forward curves, derivative pricing, and the Federal Reserve's Dot Plot provide valuable insights into market expectations and future interest rate trends. These metrics consistently indicate that the current high rates are temporary and will likely decrease significantly in the long term.3

Implications for Borrowers and Investors - The disparity between short-term and long-term interest rates has important implications for borrowers and investors:

- Borrowers: Those seeking financing options should carefully consider the cost dynamics between short-term and long-term borrowing. While loan rates are high, we can purchase mid/long-term interest rate derivatives that are below current rates/in the money.4

- Investors: Individuals and institutions investing in fixed income instruments or lending funds need to evaluate the trade-offs between short-term and long-term options. Short-term investments may potentially provide higher yields and quicker liquidity, while long-term investments offer the potential for stable returns over an extended period.

We’re “in the Money”! - Embracing the Long-Term Advantage: The cost dynamics between short-term and long-term interest rates reflect the current financial landscape. While short-term money is expensive, a comprehensive analysis of various metrics suggests that these high rates are temporary. By recognizing the advantageous position of long-term money, borrowers and investors can confidently navigate the current market conditions and position themselves strategically for a future marked by lower interest rates. We’re “in the Money”!

1 https://www.wsj.com/economy/central-banking/how-hard-should-the-fed-squeeze-to-reach-2-inflation-77dbf56f

2 https://www.chathamfinancial.com/technology/us-forward-curves

3 https://www.chathamfinancial.com/technology/us-forward-curves

4 As of 8/22/23, SOFR is 5.30%. If an interest rate cap hedging SOFR with a strike of 2.25% were purchased, the interest rate cap would be considered “in the money”. This simply means that the underlying index (SOFR @ 5.30%), has a higher rate than the interest rate cap “strike” of 2.25%.